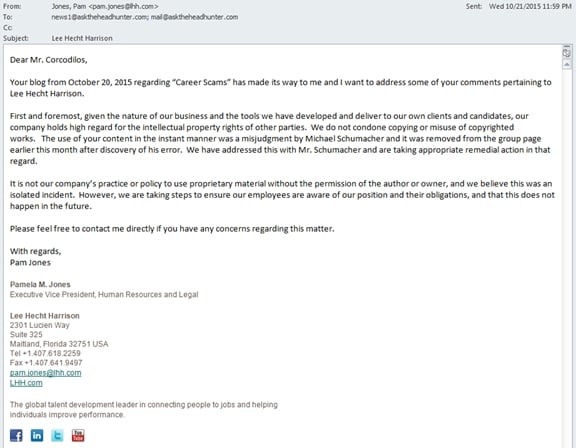

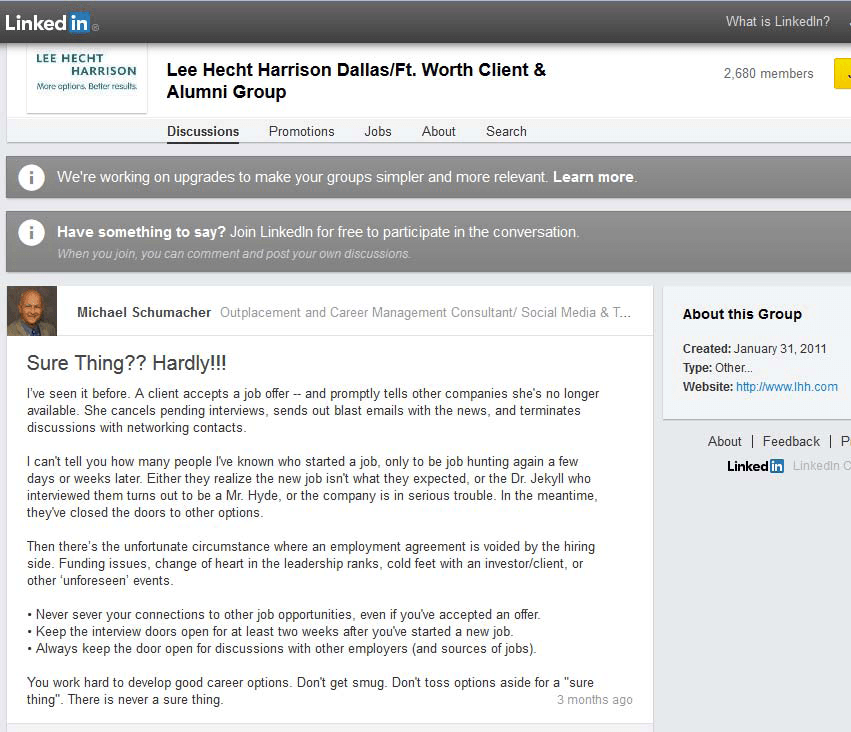

[See Update at end of this article.]

[See Update at end of this article.]

SevenFigureCareers is a recruiting firm that doesn’t recruit. Real recruiters are paid by employers to find candidates to fill jobs — they don’t charge job seekers. In a recruiting scam, you pay the fee.

SevenFigureCareers’ recruiters charge you a fee to set up bogus interviews with phony managing partners at fake private equity (PE) firms. And then you’re out $1,500, $2,500, $4,500 or $10,000 — depending on which iteration of this racket you did business with.

After months of research driven by loads of information crowd-sourced from the Ask The Headhunter community, best estimates are that this international scam has generated as much as $18 million since 1999.

A 17-year racket

The people behind this scam have operated at least four different recruiting firms that have each operated under several names themselves:

- Executive Headhunter Group (Executive HGG)

- Private Equity Headhunters (PEH)

- Executive Top Gun Search (Top Gun, ETG)

- SevenFigureCareers (7F, 7figcareers)

With each iteration, complaints have piled up on sites like RipOffReport, Scam.org, and Ask The Headhunter. Victims have sued for breach of contract, negligent misrepresentation, common law fraud, and consumer fraud — and won judgments in court.

The owners of these firms have impersonated attorneys and threatened their victims. They use invalid contracts and have had their credit card merchant account cancelled as a result. Since 1999, when the heat got too high from victims they burned, the scammers created new fake websites, new fake PE firms, and new fake recruiters — and kept running the same racket.

Who could fall for such a scam? How can a fake business collect millions in fees via credit cards? Who’s behind this — and why haven’t they been busted?

We’ve already answered the first two questions in 7F: Anatomy of A Recruiting Scam and in WWEJSS: How does a fake recruiting firm get a credit card merchant account? Information and documents supplied by people familiar with the scam lead step-by-step to companies, websites, street addresses and names that are all connected by WWEJSS, LLC, “a Texas corporation” that does not exist.

WWEJSS

In the current scam, SevenFigureCareers, victims sign a contract for services and pay thousands of dollars by credit card. As we’ve already seen, the contract is bogus because the company behind it, WWEJSS, LLC, “a Texas corporation” is phony. (Even the wording on the contract is bogus, because an LLC is not a corporation.) The Texas Secretary of State confirms there is no such legal entity registered — and it must be registered if it is to conduct business.

While the contract is legally invalid, an American Express merchant account tied to that contract was very real. The contract, the account, and the domain SevenFigureCareers.com are all tied to WWEJSS.

We know WWEJSS is phony because American Express cancelled its merchant account and refunded charges collected from cardholders for fake “services” rendered.

So, who’s behind this scam outfit, and who owns SevenFigureCareers.com?

So, who’s behind this scam outfit, and who owns SevenFigureCareers.com?

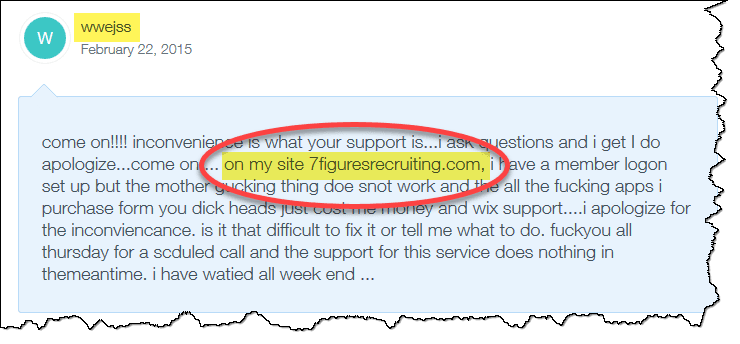

A search for WWEJSS turns up a tech-support thread loaded with profanity at Wix.com, a website developer tool. The customer wwejss refers to his website, 7figuresrecruiting.com, one of the Internet domains related to SevenFigureCareers.com.

This bit of information will be helpful later. But what we’re looking for is a name tied to WWEJSS.

Who Is It?

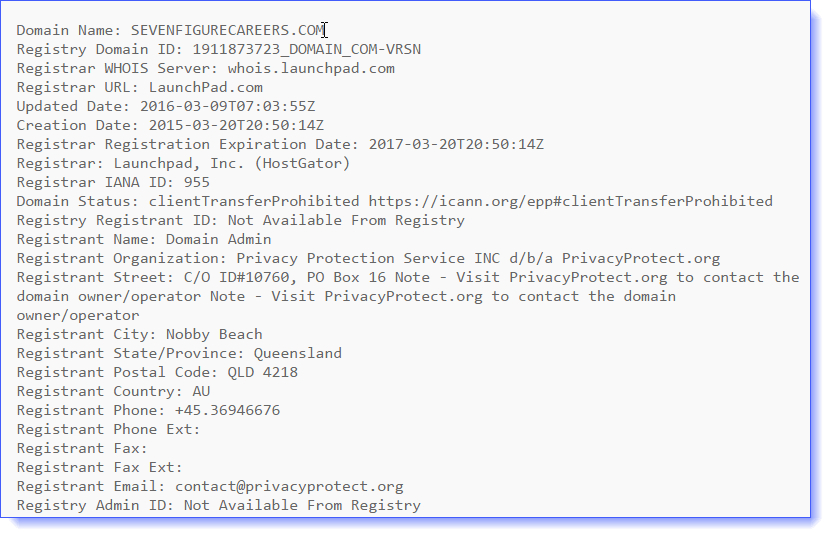

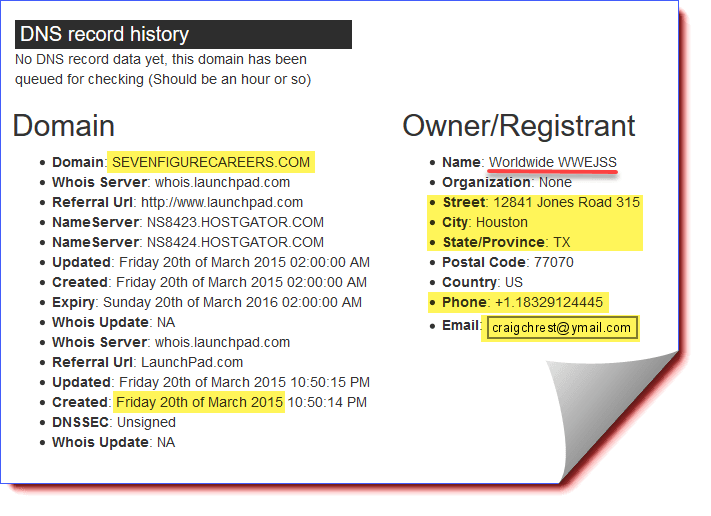

A WHOIS database search for SevenFigureCareers.com turns up a domain registration whose owner is hidden. For a few bucks, anyone can privately register a domain name. Note the creation date of this domain registration: March 20, 2015.

DNS Record History

But what’s hidden on the Internet is not always completely hidden. StatsInfinity — an Internet statistics tool — reveals a Domain Name System (DNS) record history that confirms SevenFigureCareers.com was registered on March 20, 2015.

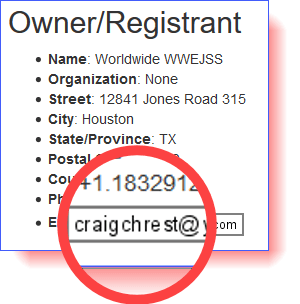

Unlike WHOIS, StatsInfinity also shows the history of the domain, which reveals the owner’s name, street address, e-mail address, and phone number. The owner’s name is listed as “Worldwide WWEJSS.”

Note the phone number: (832) 912-4445. We’ll call it later to see who answers.

Apparently, whoever established this domain locked the ownership information afterwards. But the details were captured and preserved by StatsInfinity.

Craig Chrest

Closer inspection delivers the gold nugget of information we’ve been looking for. There’s a name now connected to WWEJSS and SevenFigureCareers.com on a public document that also serves as a legal Internet registration: Craig Chrest.

Iterations of the scam

Internet research reveals that this recruiting scam is not new. Several iterations going back to at least 1999 can be traced to the same operating entity — WWEJSS — and Craig Chrest. Before we get to the name connected to SevenFigureCareers.com, let’s go back to the domain name we found on the Wix.com support page, 7figuresrecruiting.com. (If this is not a chronological history, it’s how Internet data led to each of the companies involved.)

#1: Private Equity Headhunters

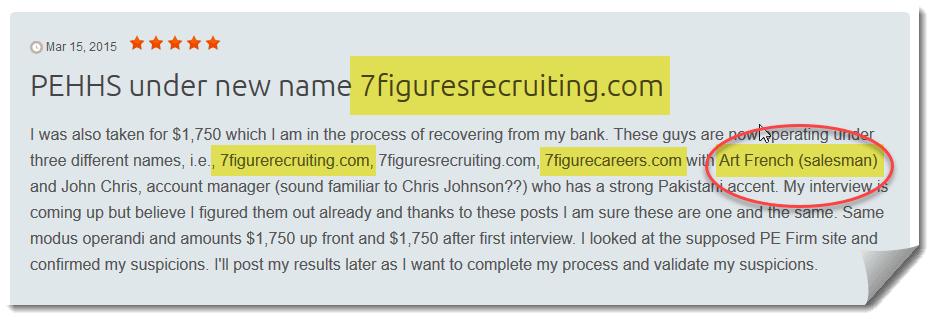

A Google search for “7figuresrecruiting.com” takes us to ScamOrg.com, where we find a lengthy report about another company, Private Equity Headhunters LLC, which pre-dates SevenFigureCareers. (You may need a score card to keep track.)

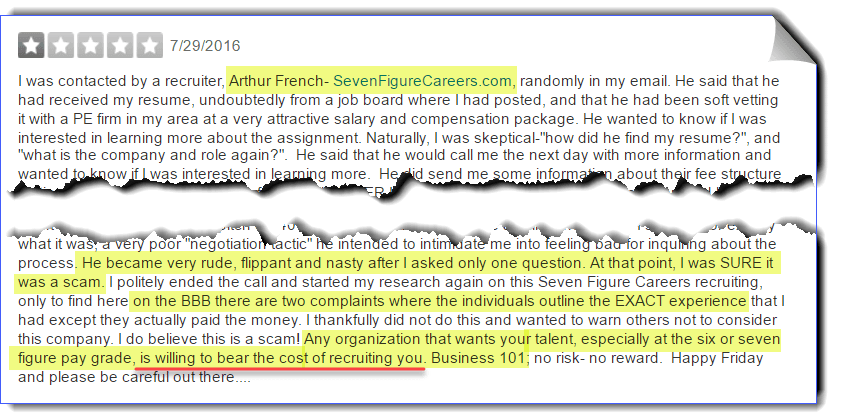

One victim connects this firm with 7figuresrecruiting. And who turns up in the complaints but “Art French (salesman),” who refers to himself in e-mails as “VP Recruiting” at SevenFigureCareers.com. (For more about Mr. French and his twin brother Tony, see 7F: Anatomy of A Recruiting Scam.)

One victim connects this firm with 7figuresrecruiting. And who turns up in the complaints but “Art French (salesman),” who refers to himself in e-mails as “VP Recruiting” at SevenFigureCareers.com. (For more about Mr. French and his twin brother Tony, see 7F: Anatomy of A Recruiting Scam.)

And right beside French is “John Chris, account manager,” known as “James Chris — V.P. Account Management” at SevenFigureCareers. He apparently goes by “Chris Johnson” at PEH.

#2: Executive Top Gun Search

An earlier recruiting firm surfaces when we examine the addresses of these entities, and it’s tied to the same owner.

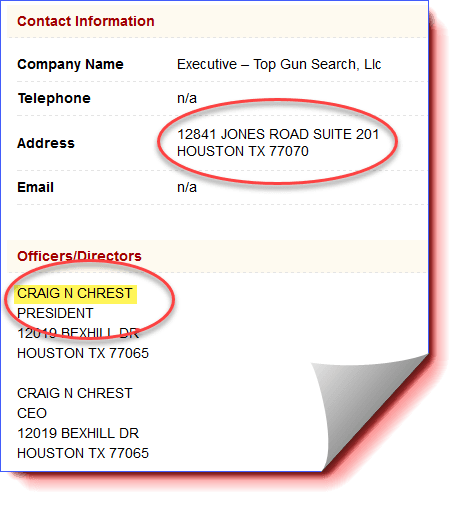

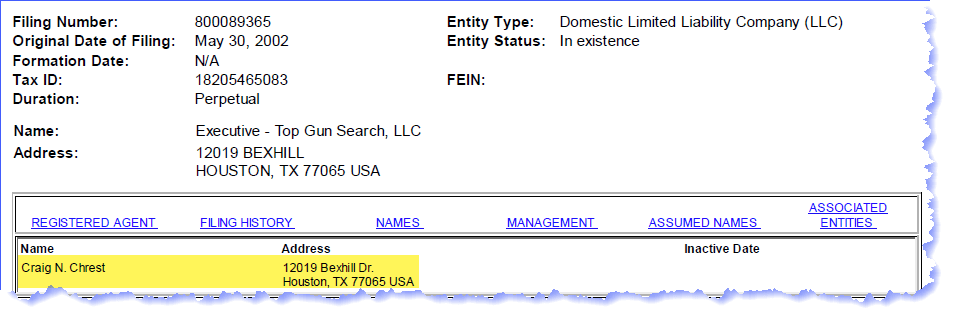

The street address on Craig Chrest’s current SevenFigureCareers.com domain registration is 12841 Jones Road, Houston, Texas. A search for this address on TexasCorporates.com turns up another Chrest property: Executive Top Gun Search, LLC — at the same address.

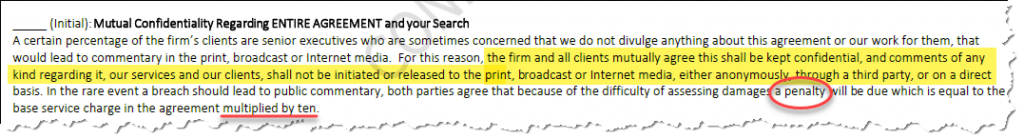

While WWEJSS and SevenFigureCareers are not legally registered entities, Executive – Top Gun Search, LLC was registered in Texas on May 30, 2002 by Craig N. Chrest at 12019 Bexhill Dr., Houston, TX, 77065. The registration is still active.

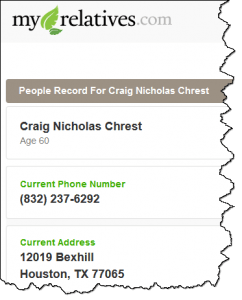

Now let’s jump forward to SevenFigureCareers. Note Chrest’s middle initial on the Top Gun registration — N. While his name is never used by anyone at SevenFigureCareers, his initials make their way into the business.  According to myrelatives.com, the N stands for Nicholas.

According to myrelatives.com, the N stands for Nicholas.

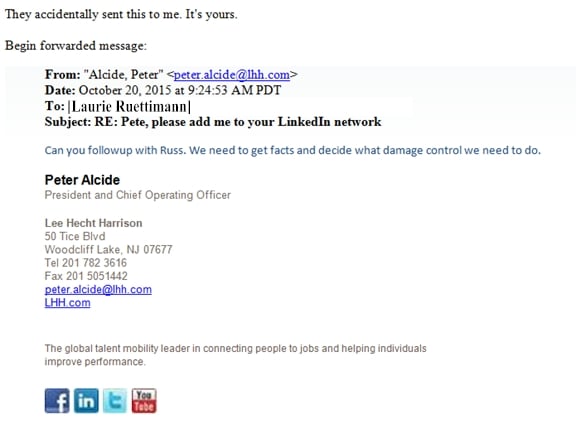

When victims of SevenFigureCareers filed disputes with American Express, the merchant was required to document the transactions and submit supporting information to AmEx. When those victims also complained to Art French, he called them back to announce “we won the settlement — we always do.” Then French offered to put them in touch with “the CEO of the company” — C.R. Nicholas — because “our CEO would like to make things right with you.”

Listen to a voicemail left by French for a victim:

“Mr. Nicholas” (CRaig Nicholas Chrest?), later left this message for the same victim:

When the victim spoke with Nicholas, Nicholas ranted about how Ask The Headhunter is “scamming” SevenFigureCareers and causing trouble — but Nicholas would “look into getting you your money back.”

French was lying, and so was Nicholas. AmEx not only refunded the victims’ money, AmEx cancelled the merchant account.

Now that we have a first, middle and last name for the owner of these companies, let’s get back to Top Gun. Websites for Executive Top Gun Search disappeared after customer complaints revealed the scam on sites like RipOffReport. (See links to complaints below.) Searches for the firm turn up nothing but complaints.

#3: The Executive Headhunter Group

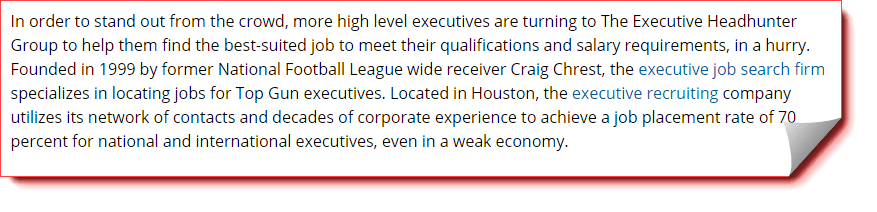

The earliest iteration of Chrest’s recruiting business is referenced in a press release that claims Craig Chrest started The Executive Headhunter Group in 1999. This glowing article on SBWire is dated 2011 and is loaded with text links to Top Gun — but they’re all dead pages.

A 2013 prweb press release refers to this iteration by another name — “Executive HHG.” It’s filled with links to a “domain for sale” page.

The firm’s website is gone, but there are plenty of complaints lodged against it and Craig Chrest. The complainants tie Executive HGG to Top Gun.

#4: SevenFigureCareers

The most recent iteration of this recruiting scam has been documented extensively on Ask The Headhunter.

The most recent iteration of this recruiting scam has been documented extensively on Ask The Headhunter.

WWEJSSLSS?

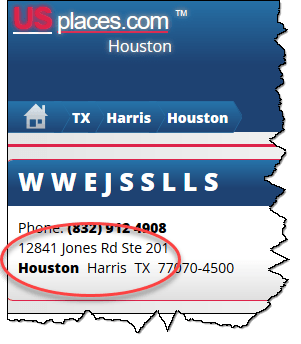

Another variation of the WWEJSS name turns up on USplaces.com — this time as WWEJSSLLS. LLS has no meaning I’ve been able to discern.

Is this another recruiting business? Perhaps it’s just another sloppy error — intended to be “LLC.” More likely it’s intended to cause more confusion for potential suckers doing their due diligence.

But it’s yet another business listed at the 12841 Jones Road address that again and again leads back to Chrest.

Unraveling WWEJSS

Legal filings connecting WWEJSS and Craig Chrest tie all the entities together with names, addresses, and telephone numbers.

There was no indication what the letters WWEJSS stood for until one of the victims pressed American Express for more detailed information about the name of this merchant on credit card bills and on the SevenFigureCareers contract. AmEx coughed up the solution: Worldwide Executive Job Search Solutions. But the only address AmEx would provide is “Suite 201, Houston, TX.” A spokesperson for American Express declined to explain why it won’t give cardholders the full address of one of its merchants.

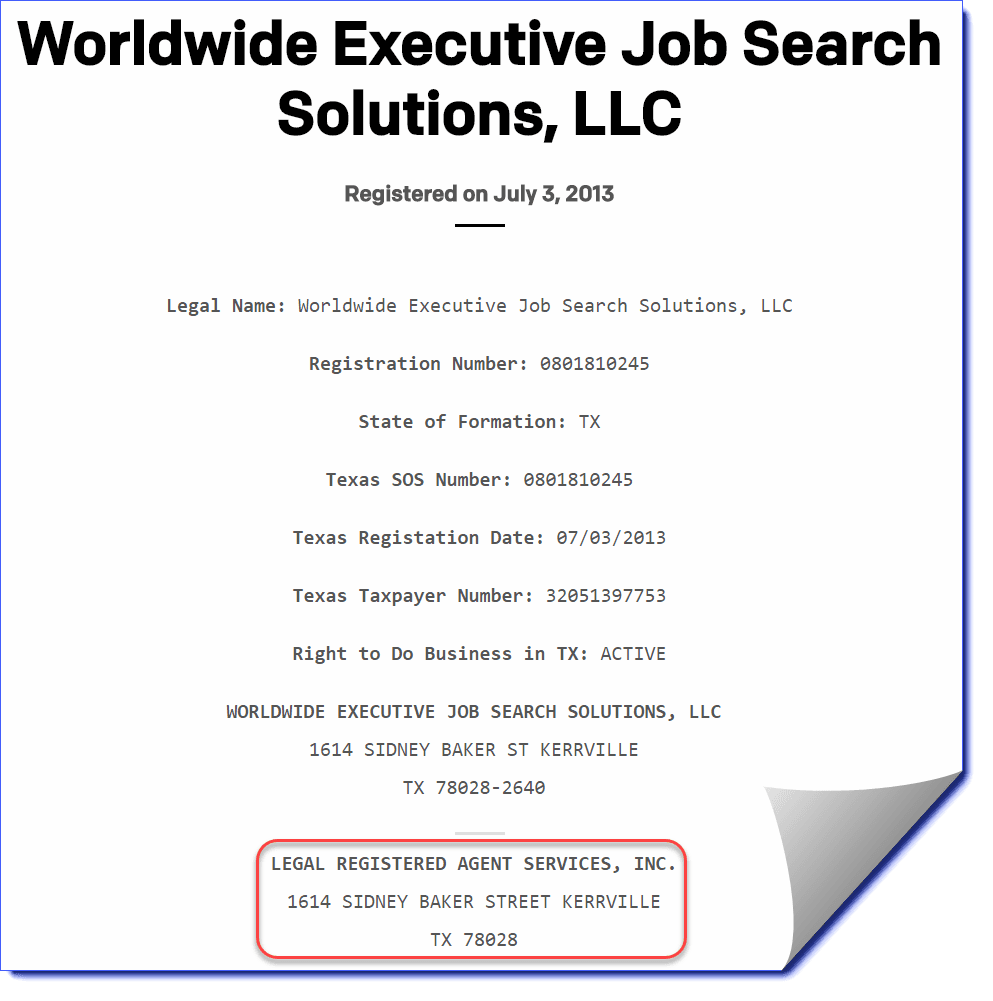

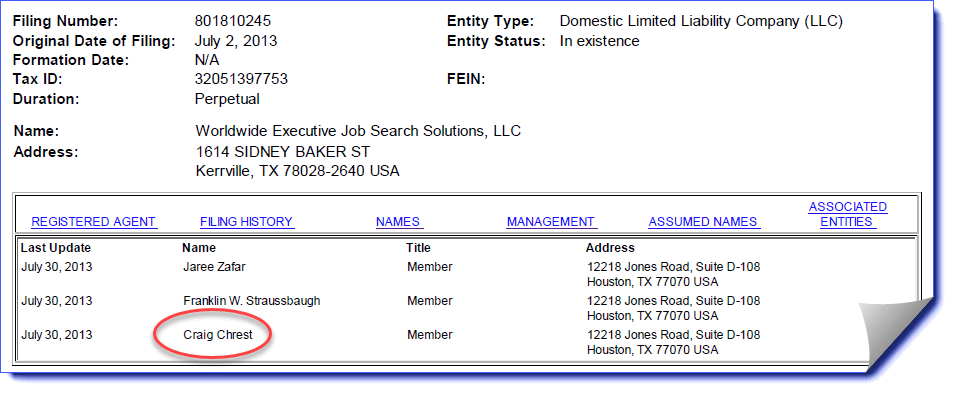

While WWEJSS is not a registered entity, thus rendering the SevenFigureCareers contract invalid, Worldwide Executive Job Search Solutions, LLC is registered in Texas. But the registration — like the SevenFigureCareers.com domain name — is hidden, this time behind a “registered agent service.” Someone doesn’t want to be found.

But in the world of government registrations, you can’t hide. Ask The Headhunter’s attorneys turned up this summary of the LLC’s true owners:

Craig Crest is listed as a member, or owner, of the LLC. The rest of the details are in the complete Certificate of Formation filed by Chrest’s partner, Franklin Wescott Straussbaugh, with the State of Texas.

LLCs are interesting legal entities. They’re not corporations and technically they’re not partnerships. They have members (owners) and they have managers. The formation certificate declared all the members managers. Less than a month later, Straussbaugh filed a Certificate of Correction making Chrest the sole manager of the LLC. The other two members, Jaree Zafar and Franklin W. Straussbaugh, remain members and owners. (Soon we’ll see that Straussbaugh is more than just a member.)

[See Update at end of this article. Zafar claims Chrest added him to the LLC without his knowledge or consent and says he is taking legal action to be removed.]

Executive Top Gun Search, LLC (a.k.a. ETG) was registered by Craig N. Chrest on May 30, 2002.

The Ask The Headhunter legal team pulled ETG’s Articles of Organization, filed May 30, 2002 by Chrest. He is the only member and manager of record.

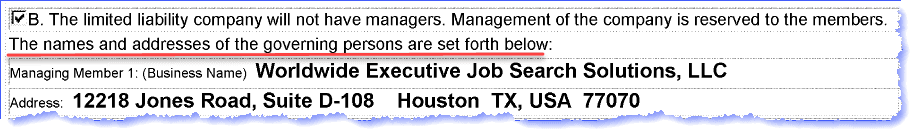

Privateequityheadhunters.Com, LLC (a.k.a. PEH) was registered June 27, 2013 by another registered agent, InCorp Services, Inc. But PEH’s Certificate of Formation shows this LLC was organized by Jaree Zafar, Chrest’s partner at Worldwide Executive Job Search Solutions, LLC. [See Update below. Zafar claims Chrest forged his digital signature.] But according to the Certificate, Craig Chrest is the real manager behind all the legal shielding — he’s the guy behind Worldwide Executive Job Search Solutions, LLC, which is listed as “the governing person…” and “Managing Member”:

By skipping from one business entity to the next, Chrest and his team tried to escape the torches and pitchforks that were pursuing them online and in the courts.

12841 Jones Rd Ste 201, Houston, Texas

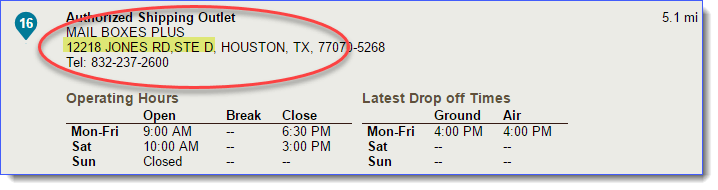

The address listed by Chrest on business filings, 12218 Jones Road, Suite D-108, Houston, TX, 77070, is a Mailboxes Plus store — a mail dropbox.

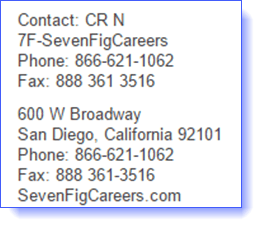

According to public records, Executive Top Gun Search (ETG), Top Gun Executive Group, Worldwide WWEJSS and WWEJSSLLS are located at 12841 Jones Road, Suite 201 in Houston, Texas, phone number (832) 912-4445. It’s not clear why American Express hides the “12841 Jones Road” part of this address from cardholders who have demanded contact information about the AmEx merchant that bilked them.

Earlier, we noted the phone number listed on the domain registration for SevenFigureCareers.com — it’s the same. While the number listed on the SevenFigureCareers website (at 600 W. Broadway, San Diego, CA), and the number C.R. Nicholas says he’s calling from, is (866) 621-1062, the telephone number under which the businesses are registered, (832) 912-4445 is answered by a man who says, “Billing.”

When I called for comments about the subject of this article, the man answering denies he is Craig Chrest and says he is not familiar with any of the firms or people we’re talking about. He says he’s not in Suite 201, but in 301. The building’s manager says there is no Suite 301 or third floor in this building, where offices are rented to lawyers and other businesses.

The voice answering (832) 912-4445 is, in my opinion, the same as the voice on voicemails left by C.R. Nicholas.

When Ask The Headhunter visited the building, we found a directory of occupants inside the front door. The business occupying Suite 201 is “CNC.” Could that refer to Craig Nicholas Chrest? This seems to be the real home of all the recruiting firms connected to WWEJSS.

Who is Craig Chrest?

Craig Chrest, the documented owner of the SevenFigureCareers.com domain is also the man who owns, manages and controls Top Gun Executive Search, Private Equity Headhunters, Executive HGG, and Worldwide Executive Job Search Solutions (WWEJSS) — but has no LinkedIn connection to any of these business entities.

What successful business person isn’t on LinkedIn? Not Arthur or Tony French. Not C.R. Nicholas or Wesley Strauss or others connected to these firms. Franklin Wescott Straussbaugh does not exist on the Internet. Not even the notable entrepreneur Mark Allen is on LinkedIn, and he’s the managing partner at the notable Agile Capital Partners who “interviewed” victims for seven-figure jobs… just on the phone.

But Craig Chrest has quite a presence online, if you know to look for him.

According to public records and to promotional materials he published himself, Craig “Chip” Chrest played football at the University of Wisconsin – LaCrosse, and later in the NFL for the Green Bay Packers and the Cleveland Browns.

Chrest published the Top Gun Executive Group’s Blog during 2011. Judging from comments on his posts, the blog was used to create a “presence” to bolster the brand. The names and comments on his posts are nonsense.

Many other Top Gun pages appear on third-party hosts, clearly intended to create as big an Internet presence as possible. For example, Yola lets anyone build a free business web presence.

Chrest published The Top Gun Executive Group on Yola. It includes a promotional headshot, reproduced here.

Chrest published The Top Gun Executive Group on Yola. It includes a promotional headshot, reproduced here.

Another photo captioned with Chrest’s name appears on a recruiting association website, Top Echelon.

A biography published on fandom reports that Chrest majored in journalism and marketing, sold software and medical equipment, and founded Executive HHG in Houston, Texas in 2013.

Top Gun In Trouble

Fandom also reports that:

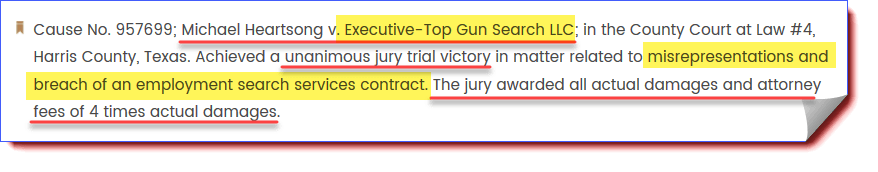

In 2013, Chrest and Top Gun were defendants in two civil court cases in which the jury awarded the plaintiff all actual damages and attorney fees of 4 times actual damages for one and subsequently additional damages for the second.

The biography links to Texas attorney Bradley J. Aiken, whose website provides more details about Michael Heartsong v. Executive-Top Gun Search LLC.

Chrest testified in this trial and lost. A unanimous jury awarded four times actual damages to the plaintiff for “misrepresentations and breach of an employment search services contract.” Michael Heartsong never collected a dime of the judgment. Chrest claimed bankruptcy.

In 2010, New Jersey resident Vincent Peters sued The Top Gun Executive Group and, after multiple appeals, in 2013 won a final judgment from the 14th Court of Appeals in the State of Texas. LawCitations.com provides details, including this excerpt:

BACKGROUND Peters is a resident of New Jersey, and Top Gun is incorporated in Texas with its principal place of business in Texas. Peters and Top Gun signed a contract for Top Gun to locate employment opportunities for Peters, among other things. Peters paid Top Gun $4,500 for the service. Peters eventually sued Top Gun in New Jersey for breach of contract, unjust enrichment, negligent misrepresentation, common law fraud, consumer fraud in violation of a New Jersey statute, and attorney‘s fees. Peters obtained a default judgment for $18,680.62 and filed the judgment in Texas pursuant to UEFJA.

According to public court records obtained at MoreLaw.com, Top Gun “owner Craig Chrest” was the only witness. Additional court documents are available at Justia.com. According to plaintiff Peters, Chrest has never paid the judgment. He claimed bankruptcy.

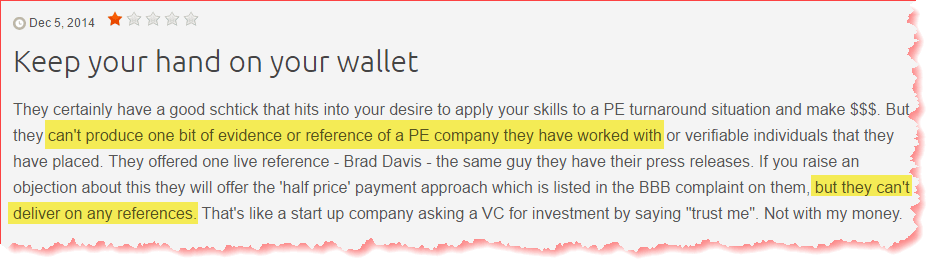

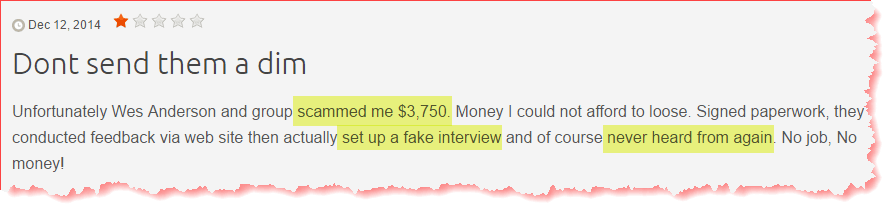

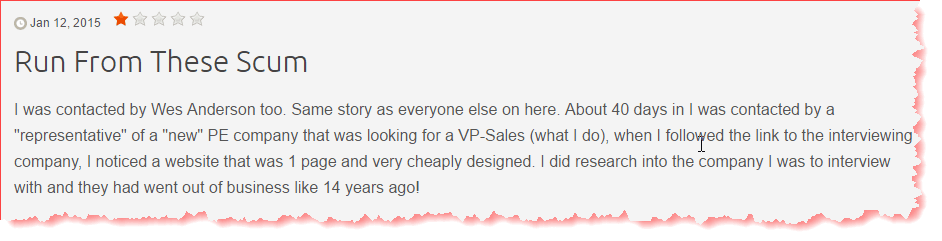

Complaints

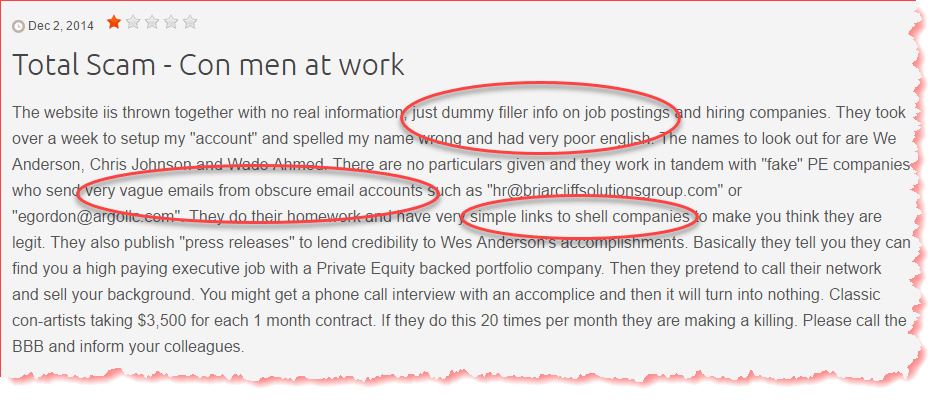

Websites connected to older iterations of Chrest’s recruiting firms have disappeared. But complaint sites document more PE firms, addresses, and names of individuals connected to this series of scams. While people posting complaints do so anonymously, their stories are consistent and the pieces fit together across sites and time.

Complaints dated 2013-2016 appear on Facebook, Yelp, Scam.org and RipOffReport and refer to Craig Chrest, Arthur French, Wes Strauss, Wes Anderson, CR Nichols, Wade Ahmed, Douglass Robinson, to “The Top Gun Executive Group AKA Executive Headhunter Group (along with other aliases),” and an enormous cast of characters.

Complaints dated 2013-2016 appear on Facebook, Yelp, Scam.org and RipOffReport and refer to Craig Chrest, Arthur French, Wes Strauss, Wes Anderson, CR Nichols, Wade Ahmed, Douglass Robinson, to “The Top Gun Executive Group AKA Executive Headhunter Group (along with other aliases),” and an enormous cast of characters.

Threats against victims

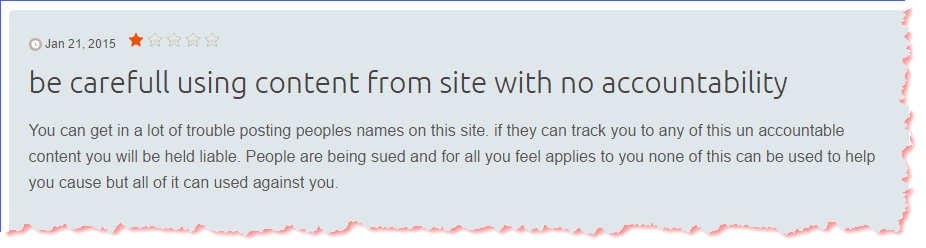

One of the RipOffReports features “retaliation responses” trying to discredit victims. The responses are never credible and offer no trackable source. A legitimate company would respond and provide a name and contact information.

Perhaps the most interesting collection of victims’ stories appears on ScamOrg.com, about Private Equity Headhunters LLC. It’s chock full of names associated with various iterations of the scam, among them some familiar to victims of SevenFigureCareers. These complaints also triggered “responses” threatening the complainers.

It seems the threats frightened some complainers into silence, including a case where the scammers posted the full name of a victim — apparently to intimidate her. But judging from Scam.org postings, victims caught on and lost their fears.

Evolution of the non-disclosure threat

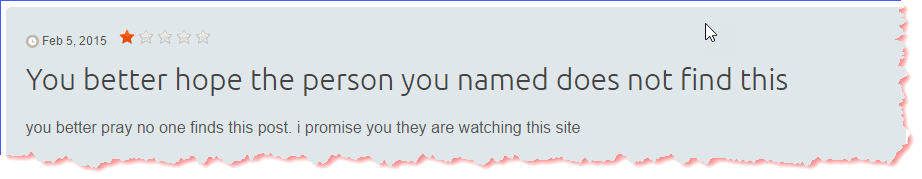

As complaints mounted, each firm disappeared and a new one popped up to replace it. This seems to explain why the newest “contract” — for SevenFigureCareers — includes a wild non-disclosure (NDA) clause that warns victims they’ll be liable for tens of thousands of dollars if they ever speak up.

This NDA strategy seems to have shut up new victims, notably John Rice, who first posted his complaint on Ask The Headhunter. Rice then asked me to remove it when a phony lawyer sent him a nasty e-mail invoking the confidentiality clause. The NDA seemed to be working — for a while.

But we learned the lawyer was fake — which prompted legal review of the contract, and investigation of WWEJSS. It’s all phony, thus the threats are once again empty. And now victims are not just posting complaints. Victims are delivering documentation that has led to the exposure of the entire ring and the whole string of recruiting companies under Craig Chrest’s registrations.

How big is the scam?

It’s big. Multi-million-dollars big.

Size of the operation

While it might seem there are many people involved in the operation discussed in this series of articles, indications are that it’s just a handful.

According to victims, Chrest handles the database and operations from Houston (including “Billing”). People familiar with Straussbaugh suggest he’s the voice on the phone — Arthur and Tony French, a.k.a. Wesley Strauss and Wes Anderson — doing the sales pitches and coddling the victims until they realize their money is gone. A changing roster of programmers seem to be helping with the back end in Pakistan. According to a 2013 prweb article, Jaree Zafar — an LLC organizer and current member — handled information technology, though his involvement today is unclear. [See Update at end of this article.]

It doesn’t take many people to run a scam when it’s automated. Judging from communications received from SevenFigureCareers by victims, boilerplate “reports” and “updates” are mail-merged with different names and sent out en masse every day to hundreds of victims and targets at a time. Most notable is the boilerplate included in supposedly confidential e-mails between French and the managing partners of PE firms. This bit of social engineering has generated loads of laughs among the Ask The Headhunter team:

Good talking to you and glad to hear Julie is doing better.

Suckers are supposed to think they’re listening in on personal repartee that reveals the close connections between Art French and his clients. But Julie is referenced in e-mail threads attributed to multiple sources and included on mails pertaining to multiple job opportunities from different “managing partners.” Poor Julie.

Big bucks

Ask The Headhunter has been contacted by people to whom Chrest has bragged about his accomplishments. How much money have victims been scammed out of since at least 1999?

Reasonable estimates are between $4 million and $10 million, possibly more. Chrest has changed his fees over 17 years to what the market will bear — $10,000 per “client,” $4,500, $2,500, $1,500. The number of victims per month is shocking.

When American Express cut off the WWEJSS merchant account, the credit card company’s fraud unit kicked into action. Victims have confirmed that AmEx has already begun refunding fraudulent charges to cardholders. VISA and MasterCard participate in a fraud clearinghouse called MATCH. Because of the scope of the scam, it’s reasonable to expect that federal authorities are investigating. One victim has reported that:

The good news is that I have all the addresses, contracts and bank info to turn over to the FBI.

The credit card companies and banks have a lot of explaining to do. Now that victims are demanding charge-backs, does anyone think the card companies are going to eat the costs in dollars and damage to their brands? How did they let this go on for 17 years?

International

Art French solicited a leading telecommunications scientist in Israel who contacted Ask The Headhunter immediately. He played cat and mouse with French while feeding along French’s e-mails and audio recordings of their conversations.

The scientist believes French found him in an executive networking database he’d recently joined. This suggests time zones and country boundaries are no obstacle when everything is done online and on the phone — and that there are many more overseas victims and targets who will come forward.

Here a condescending French pitches the “opportunity” for a phony job with Apax — a renowned London-based venture firm — and an interview with the non-existent Mark Allen. It’s all very, very confidential. (Audio approx. 3 minutes.)

At the end, French lays the hook — he’s got to get approval to “let” his victim do the interview.

In the next call, French tries to reel in the victim. He explains how “the program” works. Finally, the frustrated French discloses that an interview for the job in San Jose is going to cost $1,500. And, if the Apax job doesn’t work out, for thousands of dollars more, “7F” will make him “a client” for three months. (Audio approx. 6 minutes.)

International fraud is what attracts federal authorities. French is still waiting for the scientist in Israel to wire $2,500.

Craig Chrest: “Someone is scamming us!”

When victims have confronted Craig Nicholas Chrest — calling himself Mr. Nicholas — after they realized he’d ripped them off, he has responded that, “Someone is scamming us!” Someone was using his firm’s name, ripping people off, and making it look like it was him.

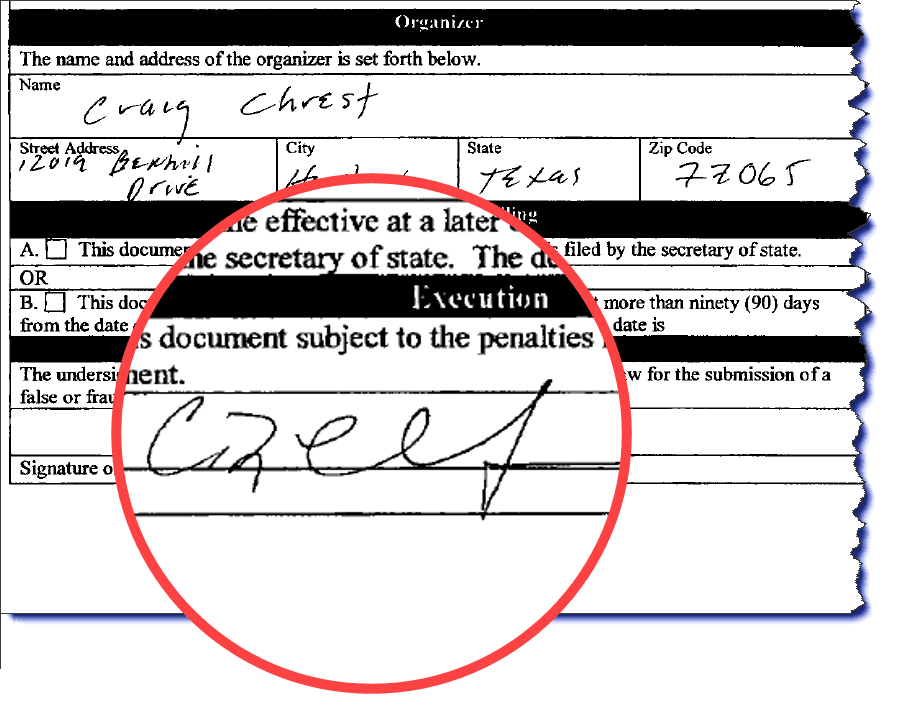

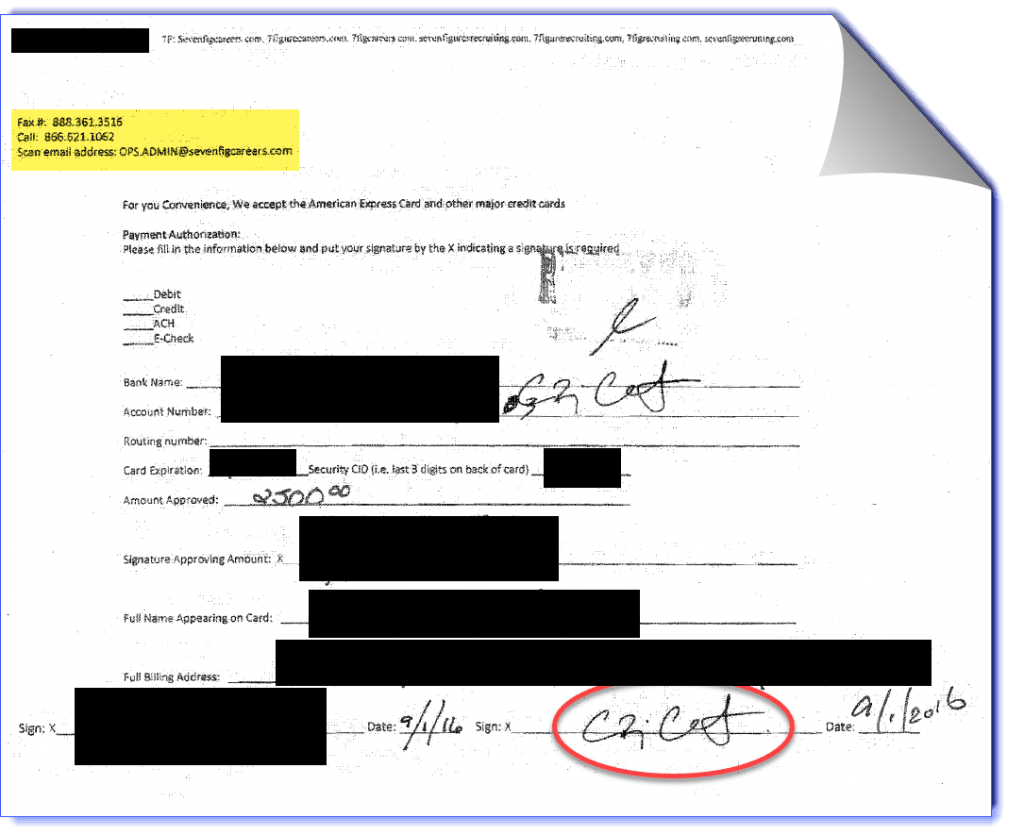

But Chrest’s signature across a span of 14 years doesn’t lie about who’s behind it all. Here it is on the 2002 Articles of Organization for Executive Top Gun Search, LLC that he filed with the Texas Secretary of State:

And here’s Chrest’s signature, dated September 1, 2016, on a contract he signed as SevenFigureCareers with one of his victims — while claiming he was C.R. Nicholas, CEO of the firm:

This particular victim’s $2,500 was refunded by American Express after the credit card company’s fraud unit turned off the lights on Chrest’s merchant account.

Scam firms beyond this series of articles

Fortune recently published two articles by Dan Primack about a recruiting scam the magazine referred to as The Ghost In The VC Machine, but they never got to the actual culprits. (See also The Venture Capital Firm That Wasn’t There.) Could these be connected to Chrest and SevenFigureCareers?

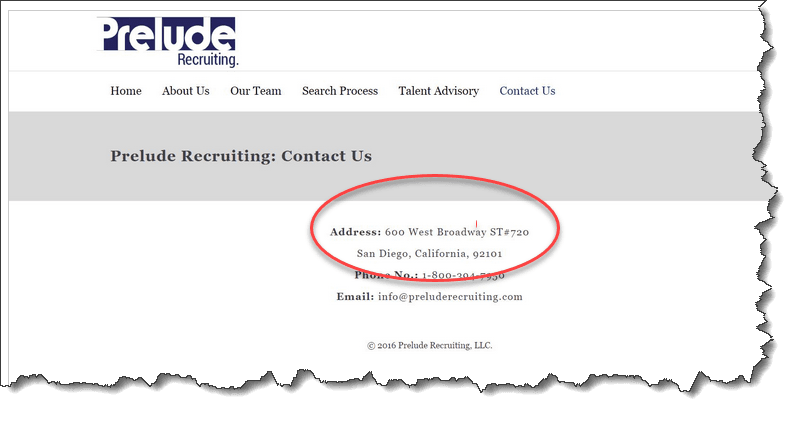

I think they are. The names are different. But note the address of one of the scam recruiting firms discussed in the Fortune article: 600 West Broadway, San Diego, California.

That’s the address of SevenFigureCareers, which appears in press releases like the one below, and on the firm’s erstwhile website, and which is confirmed by the receptionist when you call (866) 621-1062:

This scam is bigger than anyone has guessed until now.

Have you been scammed?

Repeated calls to SevenFigureCareers’ advertised phone number, (866) 621-1062 (which is also the number on the firm’s contract) to reach Art French, C.R. Nicholas, Franklin Straussbaugh, Craig Chrest, and Jaree Zafar for comment failed. Only an answering service is available. [See Update at end of this article. Zafar contacted Ask The Headhunter after publication of this article and provided a detailed comment.]

What’s interesting is that the receptionist — like the guy answering the phone at 12841 Jones Road — answers, “Billing,” then denies you’ve reached SevenFigureCareers. When pressed to speak with Art French, she goes to get him, then says “your account representative is not available” and denies any of the aforementioned individuals are at the number.

If you’re a victim of any of the recruiters and recruiting firms described, I’d like to hear from you. So far the people behind these firms have stayed far enough under the radar to trigger only small lawsuits — which the plaintiffs have always won.

The scam continues

Recently an Ask The Headhunter reader who paid SevenFigureCareers with his VISA card contacted me and referred to Chrest & Crew as the “7F CROOKS.” He said:

Anthony French solicited and sold me on a PE package and I actually got an interview with a PE firm that was questionable at best. Now their emails are all dead! I welcome a chance to share this bad experience with your readers.

Is it possible to go after people who hide behind ever-changing business names? Lawrence Barty, an attorney who has specialized in employment and labor law, offers this:

If you can identify the person who perpetrated this fraud, a tort claim of fraudulent inducement might be possible (as always, State laws vary) against that person — not against the illusory 7F. You were induced by X (identity presently unknown) to enter into a contract that cost you money, but was known in advance by X to be worthless. So, you should sue X, the person who tricked you into entering that contract. A claim of that type can be a tort claim, possibly giving rise to compensatory and punitive damages.

While Chrest’s victims have sued and won judgments in court, it seems the mistake they made was to sue his LLCs. According to attorney Barty, they should have sued Chrest personally. As in TheLadders case, individual victims need not hire lawyers. As more evidence and more plaintiffs surface, a massive consumer class action is likely the best legal strategy. (See TheLadders: How the scam works and Federal Court OK’s Suit Against TheLadders: Breach of contract & deceptive practices. This action arose out of complaints published on Ask The Headhunter, too.)

In the meantime, American Express found enough evidence in these articles to start refunding money to victims who were each defrauded of thousands of dollars by “WWEJSS.” No matter which credit card you paid with, you should contact your credit card issuer, include links to this series of articles, and ask for restitution.

All crooks are sloppy

This story started with an Ask The Headhunter reader who complained about getting scammed out of $2,500 by SevenFigureCareers on the comments section of this website. (See SevenFigureCareers: Threats and fraud.) He immediately received a threatening e-mail from a lawyer. The lawyer’s name was real — but the lawyer didn’t write the threat. He was impersonated by someone at SevenFigureCareers — a crime in all 50 states.

Arrogance makes scammers sloppy, especially when they do their business on the Internet. But when it’s on the Internet, information is forever — and any number of people can play.

Many thanks to all who have shared their experiences and information, and e-mails, contracts, recordings, and other documents to help expose this recruiting racket. Special thanks to the Ask The Headhunter legal team for digging up and reviewing documents, and for their insights, comments and legal advice. A big shout out to the field team that visited actual locations discussed in this article.

>Update: November 30, 2016

Jaree Zafar contacted Ask The Headhunter after publication of this article and says that he himself is “a victim of this fraudster,” referring to Craig Chrest.

Zafar says, “I am not his partner,” but that he worked for Chrest as an independent contractor “handling his IT needs between 2012 and 2013,” and decided to leave when he discovered Chrest’s “fraudulent practices.” He says that since 2013 he has had “absolutely nothing to do with Craig Chrest or his businesses,” that he has “not been paid a single cent from him” since 2013 — and that Chrest “still owes me thousands for my last month” of work.

Commenting on the LLC filings that bear his name, Zafar says, “I found out that [Chrest] had forged my signatures on his LLC formation and added me as a member without informing me and without my permission.”

It’s worth noting that, while Craig Chrest’s and Franklin Straussbaugh’s actual signatures appear on the Texas State filings obtained by Ask The Headhunter (see links above), Zafar’s actual signature does not. He explained that the forms were filed online and that Chrest merely had to type a name in place of an actual signature — without Zafar’s permission.

In 2013 Zafar “assumed that [Chrest] would have removed my information [from the LLCs] after receiving three demand letters from my attorney.” Unable to afford legal costs, Zafar says he did not go through with litigation.

About Chrest, Zafar says, “This guy has a long history of impersonating and defrauding people. I have contacted my attorney regarding this matter and I intend to start criminal proceedings for identity theft and fraud… but since he has all my personal information including my date of birth and social security number, I am now seriously concerned about the extent of this thief’s intentions. I am sorry for everyone who has been victimized by this fraudster.”

: :

Have you been solicited or ripped-off by a similar scam?

Comments on this post are closed. If you’ve encountered what you believe is a similar scam, send details here.

: :